Model > Decide > Simulate

Simulation for decision analysis

Start by selecting the types of variables to use in the simulation

from the Select types dropdown in the Simulate

tab. Available types include Binomial, Constant, Discrete, Log normal,

Normal, Uniform, Data, Grid search, and Sequence.

Binomial

Add random variables with a binomial distribution using the

Binomial variables inputs. Start by specifying a

Name (crash), the number of trials (n) (e.g.,

20) and the probability (p) of a success (.01). Then press

the

icon. Alternatively, enter (or remove) input directly in the text input

area (e.g., crash 20 .01).

Constant

List the constants to include in the analysis in the

Constant variables input. You can either enter names and

values directly into the text area (e.g., cost 3) or enter

a name (cost) and a value (5) in the Name and

Value input respectively and then press the

icon.

Press the

icon

to remove an entry. Note that only variables listed in the (larger)

text-input boxes will be included in the simulation.

Discrete

Define random variables with a discrete distribution using the

Discrete variables inputs. Start by specifying a

Name (price), the values (6 8), and their

associated probabilities (.3 .7). Then press the

icon.

Alternatively, enter (or remove) input directly in the text input area

(e.g., price 6 8 .3 .7). Note that the probabilities must sum to 1. If

not, a message will be displayed and the simulation cannot be run.

Log Normal

To include log normally distributed random variables in the analysis

select Log Normal from the Select types

dropdown and use Log-normal variables inputs. See the

section Normal below for additional information.

Normal

To include normally distributed random variables in the analysis

select Normal from the Select types dropdown

and use Normal variables inputs. For example, enter a

Name (demand), the Mean (1000)

and the standard deviation (St.dev., 100). Then press the

icon.

Alternatively, enter (or remove) input directly in the text input area

(e.g., demand 1000 100).

Poisson

The Poisson distribution is useful to simulate the number of times

and event occurs in a particular time span, such as the number of

patients arriving in an emergency room between 10 and 11pm. To include

Poisson distributed random variables in the analysis select

Poisson from the Select types dropdown and use

Poisson variables inputs. For example, enter a

Name (patients) and a value for the number of

occurrences Lambda the event of interest (20). Then press

the

icon. Alternatively, enter (or remove) input directly in the text input

area (e.g., patients 20).

Uniform

To include uniformly distributed random variables in the analysis

select Uniform from the Select types dropdown.

Provide parameters in the Uniform variables inputs. For

example, enter a Name (cost), the

Min (10) and the Max (15) value. Then press

the

icon. Alternatively, enter (or remove) input directly in the text input

area (e.g., cost 10 15).

Data

To include variables from a separate data-set in the calculations

specified in the Simulation formulas input box, choose a

data-set from the Input data for calculations dropdown.

This can be very useful in combination with the Grid search

feature for portfolio optimization. However, when used in conjunction

with other inputs care must be taken to ensure the number of values

returned by different calculations is the same. Otherwise you will see

an error like:

Error: arguments imply differing number of rows: 999, 3000

Grid search

To include a sequence of values select Grid search from

the Select types dropdown. Provide the minimum and maximum

values as well as the step-size in the Grid search inputs.

For example, enter a Name (price), the

Min (4), Max (10), and Step

(0.01) value. If multiple variables are specified in

Grid search all possible value combinations will be created

and evaluated in the simulation. For example, suppose a first variable

is defined as x 1 3 1 and a second as y 4 5 1

in the Grid search text input then the following data is

generated:

| x | y |

|---|---|

| 1 | 4 |

| 2 | 4 |

| 3 | 4 |

| 1 | 5 |

| 2 | 5 |

| 3 | 5 |

Note that if Grid search has been selected the number of

values generated will override the number of simulations or repetitions

specified in # sims or # reps. If this is not

what you want use Sequence. Then press the

icon.

Alternatively, enter (or remove) input directly in the text input area

(e.g., price 4 10 0.01).

Sequence

To include a sequence of values select Sequence from the

Select types dropdown. Provide the minimum and maximum

values in the Sequence variables inputs. For example, enter

a Name (trend), the Min (1) and

the Max (1000) value. Note that the number of ‘steps’ is

determined by the number of simulations. Then press the

icon.

Alternatively, enter (or remove) input directly in the text input area

(e.g., trend 1 1000).

Formulas

To perform a calculation using the generated variables, create a

formula in the Simulation formulas input box in the main

panel (e.g., profit = demand * (price - cost)). Formulas

are used to add (calculated) variables to the simulation or to update

existing variables. You must specify the name of the new variable to the

left of a = sign. Variable names can contain letters,

numbers, and _ but no other characters or spaces. You can

enter multiple formulas. If, for example, you would also like to

calculate the margin in each simulation press return after

the first formula and type margin = price - cost.

Many of the same functions used with Create in the

Data > Transform tab and in Filter data in

Data > View can also be included in formulas. You can use

> and < signs and combine them. For

example x > 3 & y == 2 would evaluate to

TRUE when the variable x has values larger

than 3 AND y has values equal to 2. Recall

that in R, and most other programming languages, = is used

to assign a value and == to evaluate if the value

of a variable is exactly equal to some other value. In contrast

!= is used to determine if a variable is unequal

to some value. You can also use expressions that have an

OR condition. For example, to determine when

Salary is smaller than $100,000 OR larger

than $20,000 use Salary > 20000 | Salary < 100000.

| is the symbol for OR and

& is the symbol for AND (see also the

help file for Data > View).

A few additional examples of formulas are shown below:

- Create a new variable z that is the difference between variables x and y

- Create a new

logicalvariable z that takes on the value TRUE when x > y and FALSE otherwise

- Create a new

logicalz that takes on the value TRUE when x is equal to y and FALSE otherwise

- The command above is equivalent to the one below using

ifelse. Note the similarity toifstatements in Excel

ifelsestatements can be used to create more complex (numeric) variables as well. In the example below, z will take on the value 0 if x is smaller than 60. If x is larger than 100, z is set equal to 1. Finally, when x is 60, 100, or between 60 and 100, z is set to 2. Note: make sure to include the appropriate number of opening(and closing)brackets!

- To create a new variable z that is a transformation of variable x but with mean equal to zero:

- To create a new variable z that shows the absolute values of x:

- To find the value for

pricethat maximizesprofituse thefind_maxcommand. In this examplepricecould be a random orSequence variable. There is also afind_mincommand.

- To determine the minimum (maximum) value for each pair of values

across multiple variables (e.g., x and y) use the functions

pminandpmax. In the example below, z will take on the value of x when x is larger than y and take on the value of y otherwise.

See the table below for an example:

| x | y | pmax(x,y) |

|---|---|---|

| 1 | 0 | 1 |

| 2 | 3 | 3 |

| 3 | 8 | 8 |

| 4 | 2 | 4 |

| 5 | 10 | 10 |

- Similar to

pminandpmaxa number of functions are available to calculate summary statics across multiple variables. For example,psumcalculates the sum of elements across different vectors. See https://radiant-rstats.github.io/radiant.data/reference/pfun.html for more information.

See the table below for an example:

| x | y | psum(x,y) |

|---|---|---|

| 1 | 0 | 1 |

| 2 | 3 | 5 |

| 3 | 8 | 11 |

| 4 | 2 | 6 |

| 5 | 10 | 15 |

Other commonly used functions are ln for the natural

logarithm (e.g., ln(x)), sqrt for the

square-root of x (e.g., sqrt(x)) and square to

calculate square of a variable (e.g., square(x)).

To return a single value from a calculation use functions such as

min, max, mean, sd,

etc.

- A special function useful for portfolio optimization is

sdw. It takes weights and variables as inputs and returns the standard deviation of the weighted sum of the variables. For example, to calculated the standard deviation for a portfolio of three stocks (e.g., Boeing, GM, and Exxon) you could use the equation below in theSimulation formulasinput.fandgcould be values (e.g., 0.2 and 0.8) or vectors of different weights specified in aGrid searchinput (see above).Boeing,GM, andExxonare names of variables in a data-set included in the simulation using aDatainput (see above).

For an example of how the simulate tool could be used for portfolio optimization see the state-file available for download here

Functions

It is possible that the standard functions available in R are not

sufficiently flexible to conduct the simulation you have in mind. If

this is the case, click on the Add functions check box on

the bottom left of your screen and can create your own custom function

in the Simulation functions input box in the main panel. To

learn about writing R-functions see

https://www.statmethods.net/management/userfunctions.html

for a good place to start.

For an example of how to use custom R-functions in a gambling simulation, see the state-file available for download here. The report generated through Report > Rmd provides additional information about the simulation setup and the use of functions.

Running the simulation

The value shown in the # sims input determines the

number of simulation draws. To redo a simulation with the same

randomly generated values, specify a number in the

Set random seed input (e.g., 1234).

To save the simulated data for further analysis, specify a name in

the Simulated data input box. You can then investigate the

simulated data by choosing the data with the specified name from the

Datasets dropdown in any of the Data tabs (e.g.,

Data > View, Data > Visualize, or Data >

Explore).

When all required inputs have been specified press the

Simulate button to run the simulation.

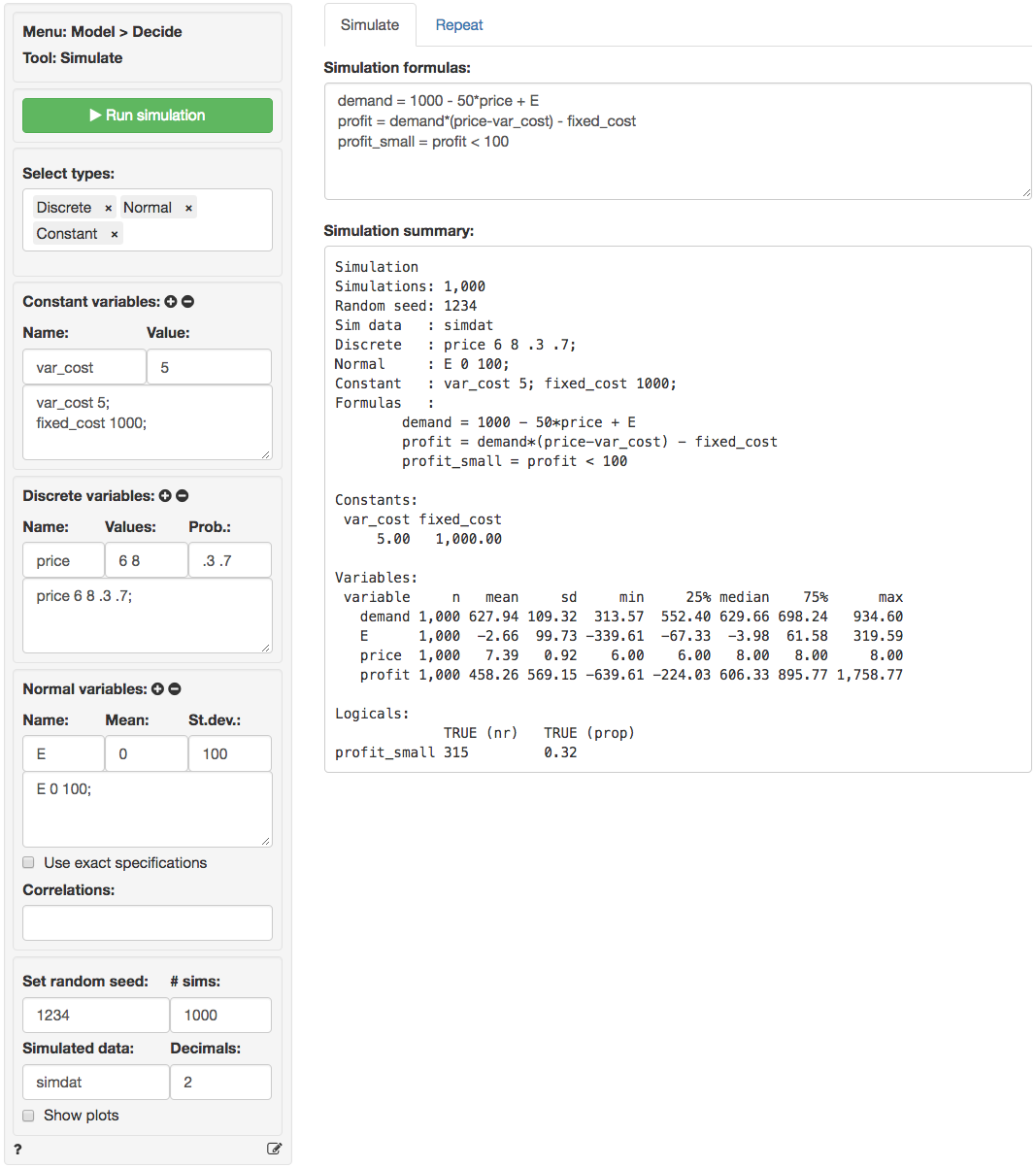

In the screen shot below var_cost and

fixed_cost are specified as constants. E is

normally distributed with a mean of 0 and a standard deviation of 100.

price is a discrete random variable that is set to $6 (30%

probability) or $8 (70% probability). There are three formulas in the

Simulation formulas text-input. The first establishes the

dependence of demand on the simulated variable

price. The second formula specifies the profit function.

The final formula is used to determine the number (and proportion) of

cases where profit is below 100. The result is assigned to a new

variable profit_small.

In the output under Simulation summary we first see

details on the specification of the simulation (e.g., the number of

simulations). The section Constants lists the value of

variables that do not vary across simulations. The sections

Random variables and Logicals list the

outcomes of the simulation. We see that average demand in

the simulation is 627.94 with a standard deviation of 109.32. Other

characteristics of the simulated data are also provided (e.g., the

maximum profit is 1758.77). Finally, we see that the probability of

profits below 100 is equal 0.32 (i.e., profits were below

$100 in 315 out of the 1,000 simulations).

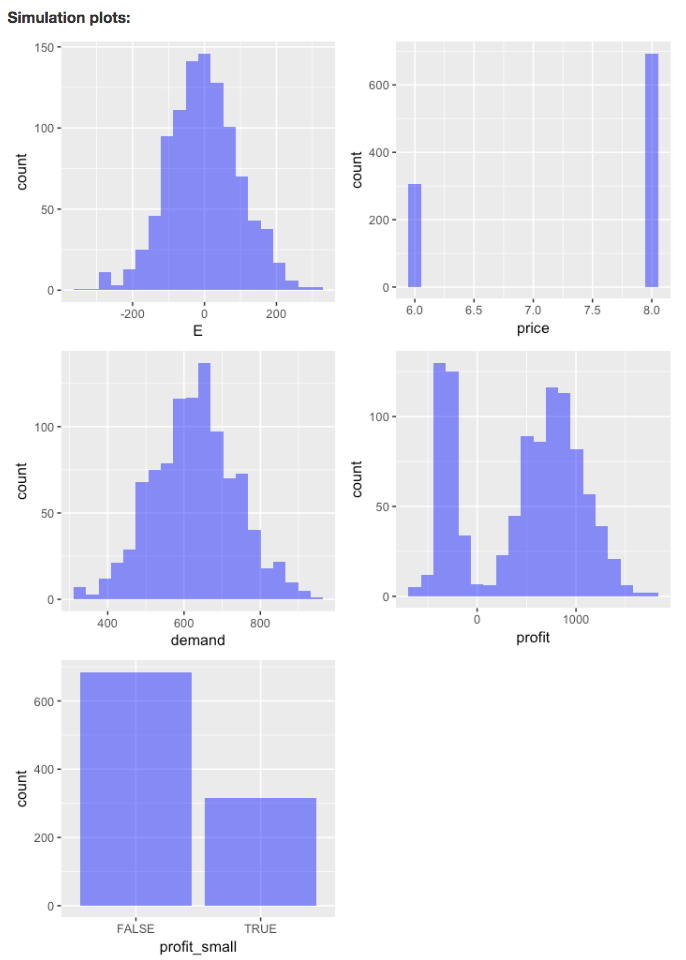

To view histograms of the random variables as well as the variables

created using Simulation formulas ensure

Show plots is checked.

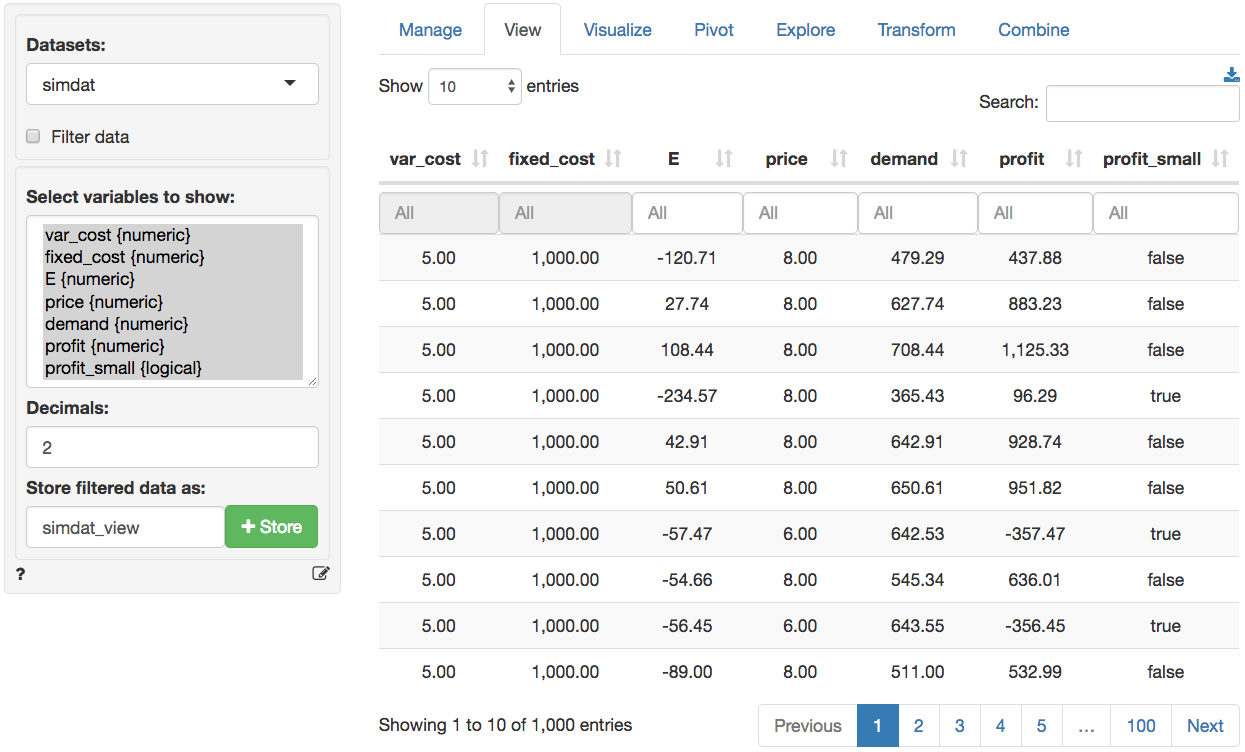

Because we specified a name in the Simulated data box

the data are available as simdat within Radiant (see screen

shots below). To use the data in Excel click the download icon on the

top-right of the screen in the Data > View tab or go to the

Data > Manage tab and save the data to a csv file (or use

the clipboard feature). For more information see the help file for the

Data > Manage tab.

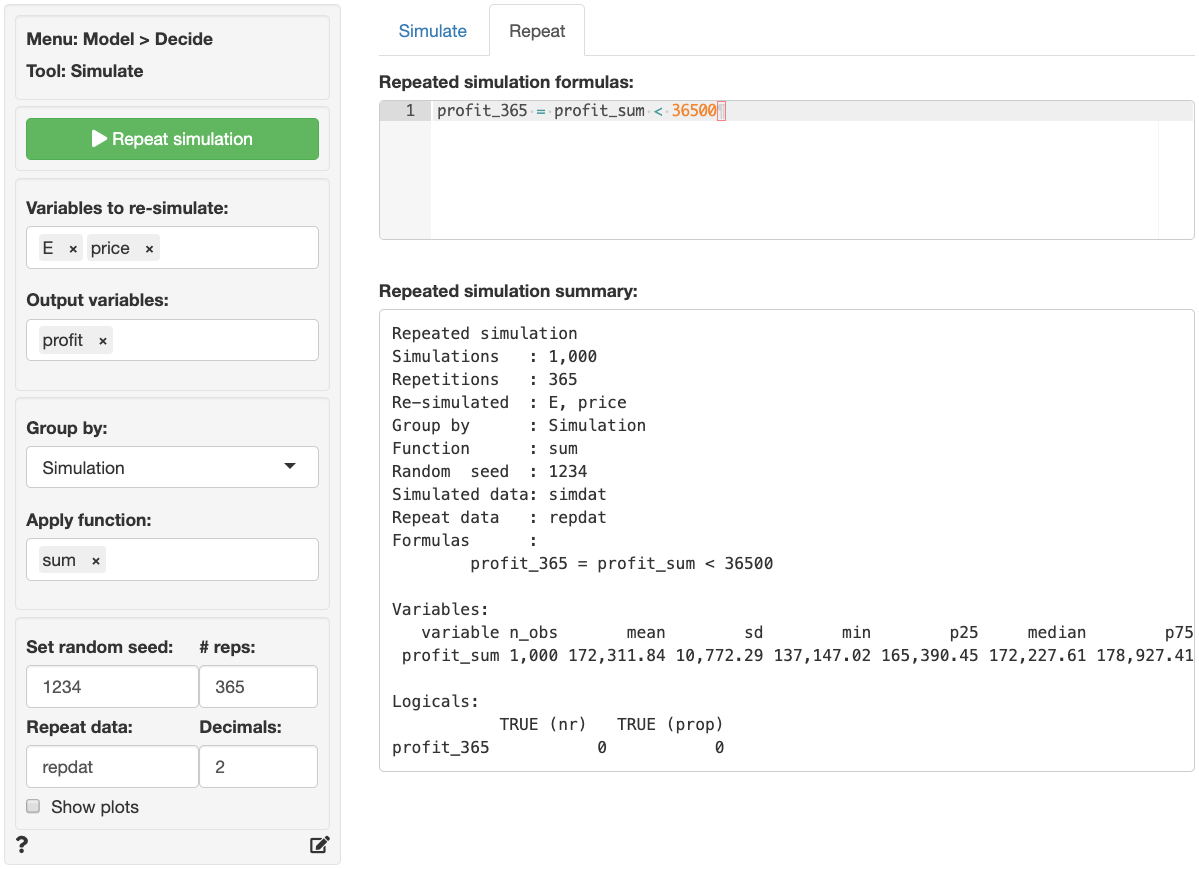

Repeating the simulation

Suppose the simulation discussed above was used to get a better

understanding of daily profits. To develop insights into annual profits

we could re-run the simulation 365 times. However, this can be done more

conveniently by using the functionality available in the Repeat

tab. First, select the Variables to re-simulate, here

E and price. Then select the variable(s) of

interest in the Output variables box (e.g.,

profit). Set # reps to 365.

Next, we need to determine how to summarize the data. If we select

Simulation in Group by the data will be

summarized for each draw in the simulation across 365

repeated simulations resulting in 1,000 values. If we select

Repeat in Group by the data will be summarized

for each repetition across 1,000 simulations resulting

in 365 values. If you imagine the full set of repeated simulated data as

a table with 1,000 rows and 365 columns, grouping by

Simulation will create a summary statistic for each row and

grouping by Repeat will create a summary statistic for each

column. In this example we want to determine the sum of

simulated daily profits across 365 repetitions so we select

Simulation in the Group by box and

sum in the Apply function box.

To determine, the probability that annual profits are below $36,500

we enter the formula below into the

Repeated simulation formula text input.

Note that profit_sum is the sum of repeated

simulations of the profit variable defined in the

Simulate tab. When you are done with the input values click the

Repeat button. Because we specified a name for

Repeat data a new data set will be created.

repdat will contain the summarized data grouped per

simulation (i.e., 1,000 rows). To store all 365 x 1,000

simulations/repetitions select none from the

Apply function dropdown.

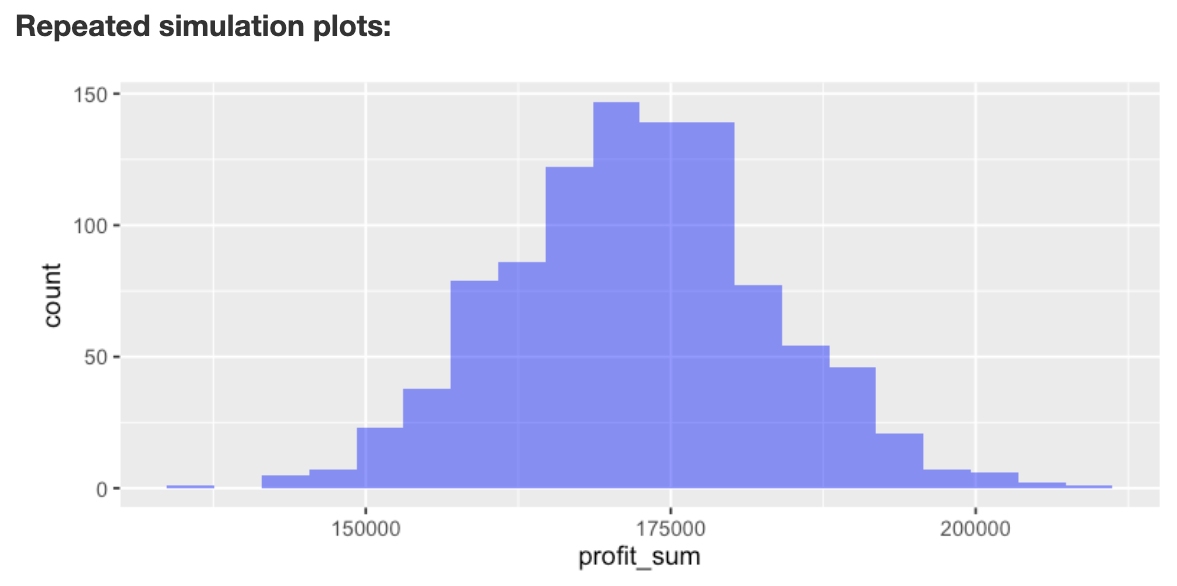

Descriptive statistics for the repeated simulation are shown in the

main panel under Repeated simulation summary. We see that

the annual expected profit (i.e., the mean of profit_sum)

for the company is 172,311.84 with a standard deviation of 10,772.29.

Although we found above that daily profits can be below $100, the chance

that profits are below \(365 \times

100\) for the entire year are slim to none (i.e., the proportion

of repeated simulations with annual profits below $36,500 is equal to

0).

If Show plots is checked a histogram of annual profits

(profit_sum) is shown under

Repeated simulation plots. There is no plot for

profit_365 because it has only one value (i.e., FALSE).

The state-file for the example in the screenshots above is available for download here

For a simple example of how the simulate tool could be used to find the price that maximizes profits see the state-file available for download here

Using Grid Search in the Repeat tab

Note that the Repeat tab also has the option to use a

Grid search input to repeat a simulation by replacing one

or more Constants specified in the Simulation

tab in an iterative fashion. This input option is shown only when

Group by is set to Repeat. Provide the minimum

and maximum values as well as the step-size in the

Grid search inputs. For example, enter a Name

(price), the Min (4), Max (10),

and Step (0.01) value. If multiple variables are specified

in Grid search all possible value combinations will be

created and evaluated in the simulation. Note that if

Grid search has been selected the number of values

generated will override the number of repetitions specified in

# reps. Then press the

icon.

Alternatively, enter (or remove) input directly in the text area (e.g.,

price 4 10 0.01).

Report > Rmd

Add code to

Report

> Rmd to (re)create the analysis by clicking the

icon on the bottom

left of your screen or by pressing ALT-enter on your

keyboard.

If a plot was created it can be customized using ggplot2

commands or with patchwork. See example below and

Data

> Visualize for details.

R-functions

For an overview of related R-functions used by Radiant to construct and evaluate (repeated) simulation models see Model > Simulate.

Key functions from the stats package used in the

simulater tool are rbinom,

rlnorm, rnorm, rpios, and

runif

Video Tutorials

Copy-and-paste the full command below into the RStudio console (i.e., the bottom-left window) and press return to gain access to all materials used in the simulation module of the Radiant Tutorial Series:

usethis::use_course("https://www.dropbox.com/sh/72kpk88ty4p1uh5/AABWcfhrycLzCuCvI6FRu0zia?dl=1")

Setting Up a Simulation in Radiant (#1)

- This video demonstrates how to use Radiant to set up a simulation

- Topics List:

- Brief introduction to the Poisson distribution

- Specifying a simulation

- Interpretation of the simulation summary

Setting Up a Repeated Simulation in Radiant (#2)

- This video shows how to use Radiant to set up a repeated simulation

- Topics List:

- Specifying a repeated simulation

- Interpretation of the repeated simulation summary

Using simulation to solve probability questions (#3)

- This video demonstrates how to use simulation to solve probability questions in Radiant

- Topics List:

- Review of setting up a (repeated) simulation

- Interpretation of the simulation summary

- Intuition of how repeated simulations work

- This video discusses some helpful functions that are commonly used in simulation formulas

- Topics List:

- Use

ifelseto specify a simulation formula - Use

pmaxto specify a simulation formula

- Use

Using Grid Search in Simulation (#5)

- This video demonstrates how to use grid search in simulation

- Topics List:

- Find an optimal value by sorting simulated data or create a plot

- Find an optimal value by using the

find_maxfunction