Multivariate > Maps > (Dis)similarity

Brand maps based on (dis)similarity data can be analyzed using Multi-Dimensional Scaling (MDS)

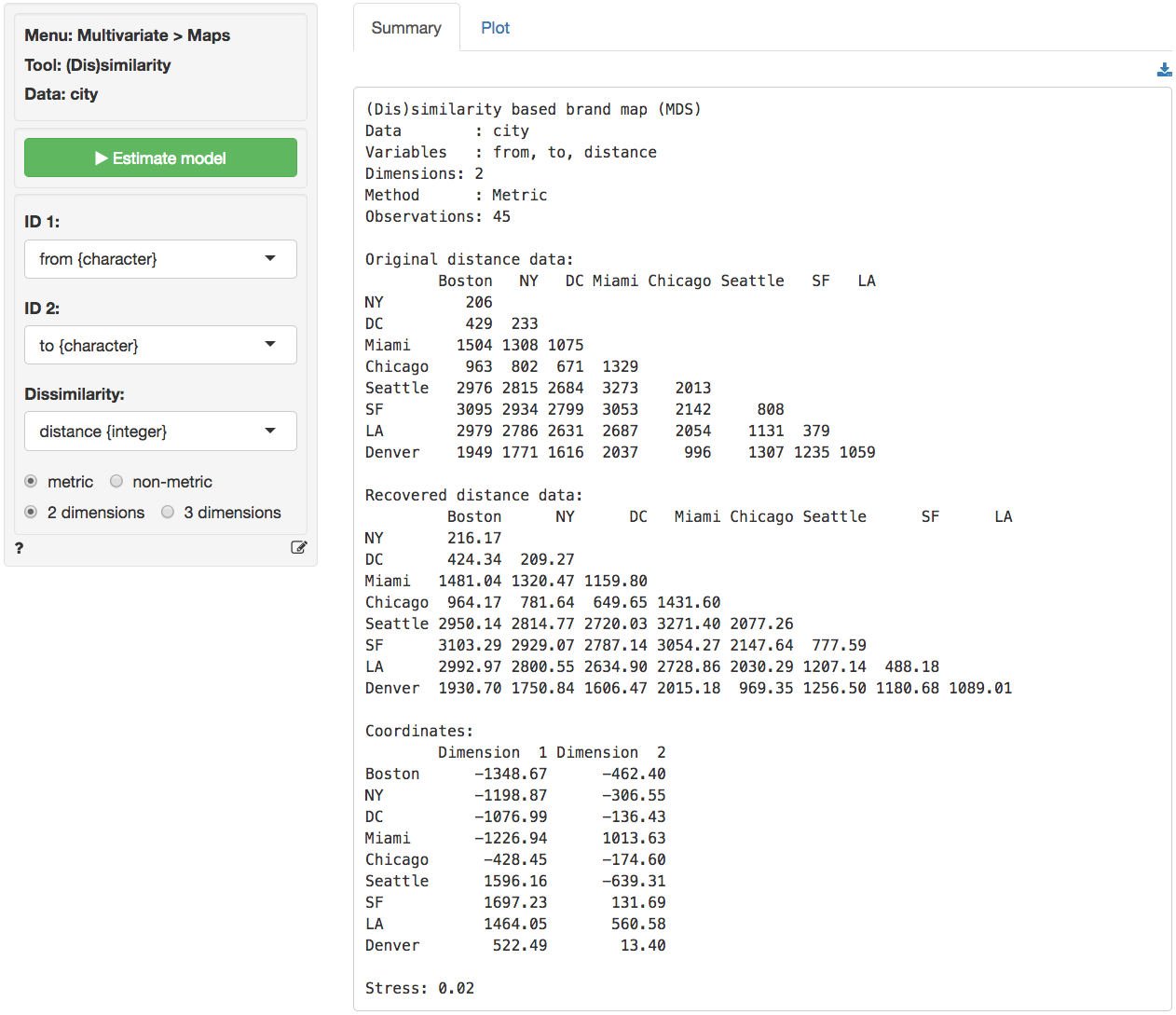

Example 1

The city data (city) contains information on distances

in miles between 10 major cities in the US. Distances for 45 (10 x 9 /

2) from-to city pairs are provided. These data are used to illustrate

that MDS can take simple data on distances (or on brand dissimilarities

as we will see) and create a 2-dimensional map that accurately depicts

the relative city (or brand) positions.

To load the city data go to Data > Manage,

select examples from the Load data of type

dropdown, and press the Load button. Then select the

city dataset. In Multivariate > Maps >

(Dis)similarity select from as ID 1, to

as ID 2, and distance as the Dissimilarity measure. After

the settings have been changed click the Estimate model

button or press CTRL-enter (CMD-enter on

macOS) to generate results.

The original distances are shown in (lower triangular) matrix form in the screenshot below. If the analysis is successful we expect cities that are close (e.g., Washington DC and New York) to also be located close together on the map. Cities that are far apart (e.g., Seattle and Miami) should also be positioned far apart in the map.

The basic measure of (lack of) fit for MDS is called

Stress. If MDS cannot create a map that accurately

describes the original data this will result in high stress. Stress

values of .1 are generally considered fair, .05 is good, and .01 or

lower is excellent. High stress values indicate that a dimensionality of

three (or higher) is needed to accurately depict the available data. For

the city data the stress value is equal to .02 which is good. In the

Summary tab we also see the coordinates that will be used to

create the two-dimensional map shown in the Plot tab and the

recovered distances (i.e., how far the cities are apart in the

generated map).

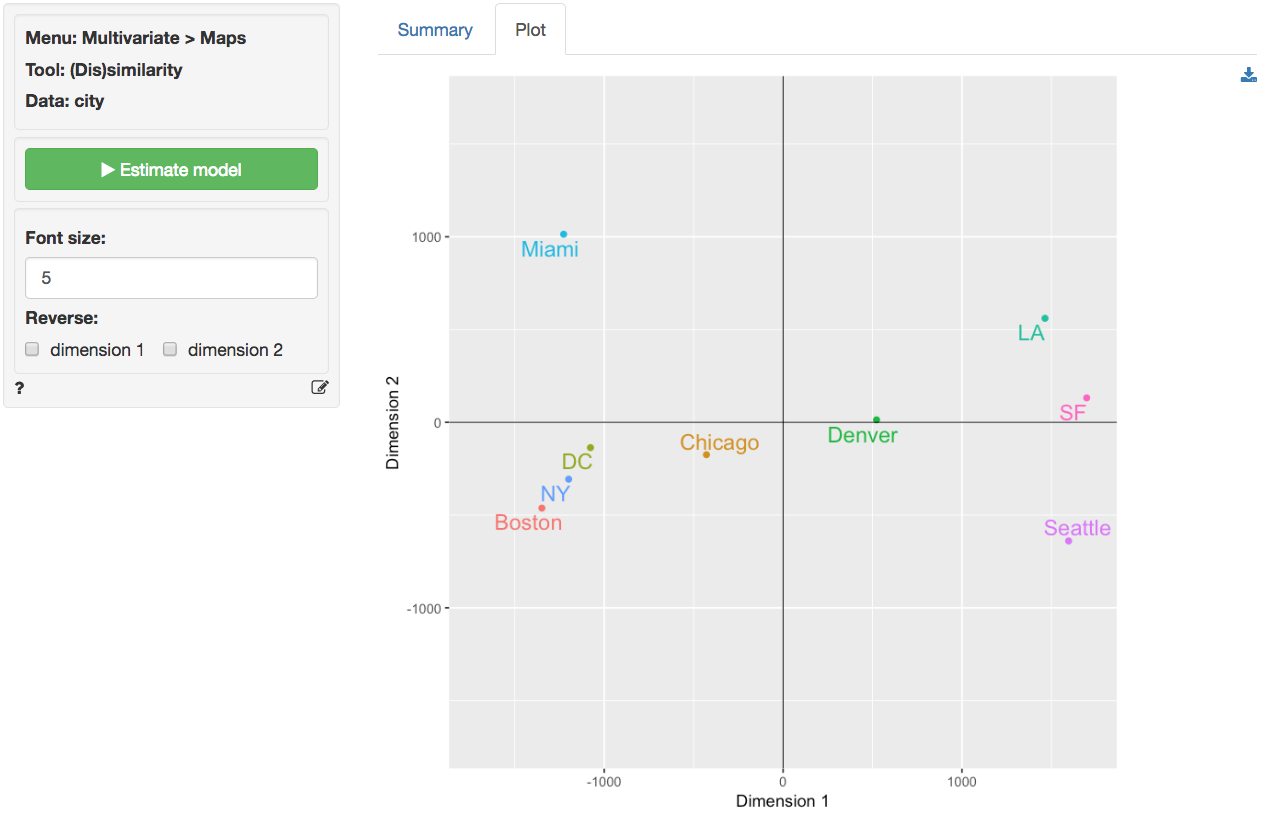

In the screen shot from the Plot tab shown below the relative locations of Los Angeles, Boston, etc. look wrong. This is due to the fact the MDS program has no information on North, South, East and West. We can flip the plot to see if the map becomes easier to recognize and interpret.

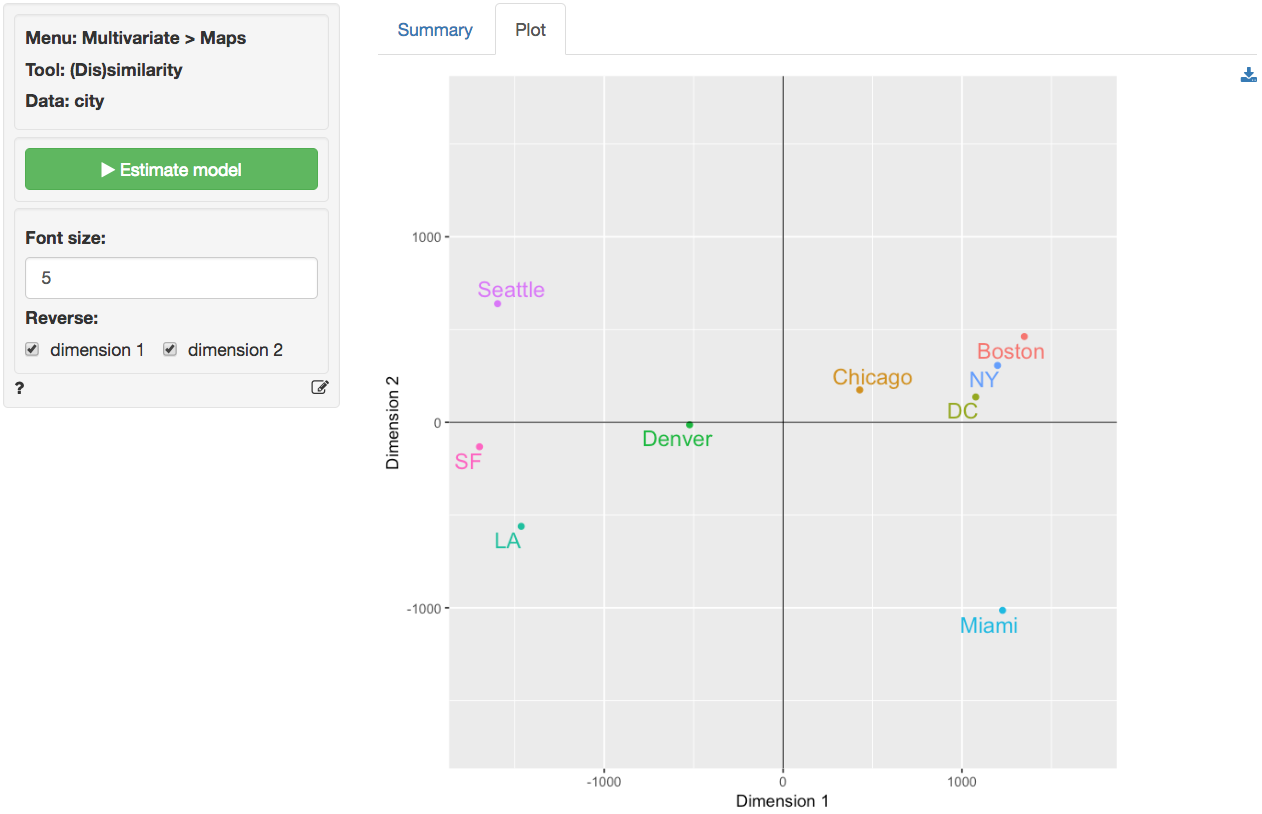

To create the plot shown below click the check-boxes for

dimension 1 and dimension 2. After

flipping the plot along both the horizontal and vertical axis

we see that the relative locations of the cities look quite good. Note

that this map is flat, i.e., there is no correction for the

curvature of the earth.

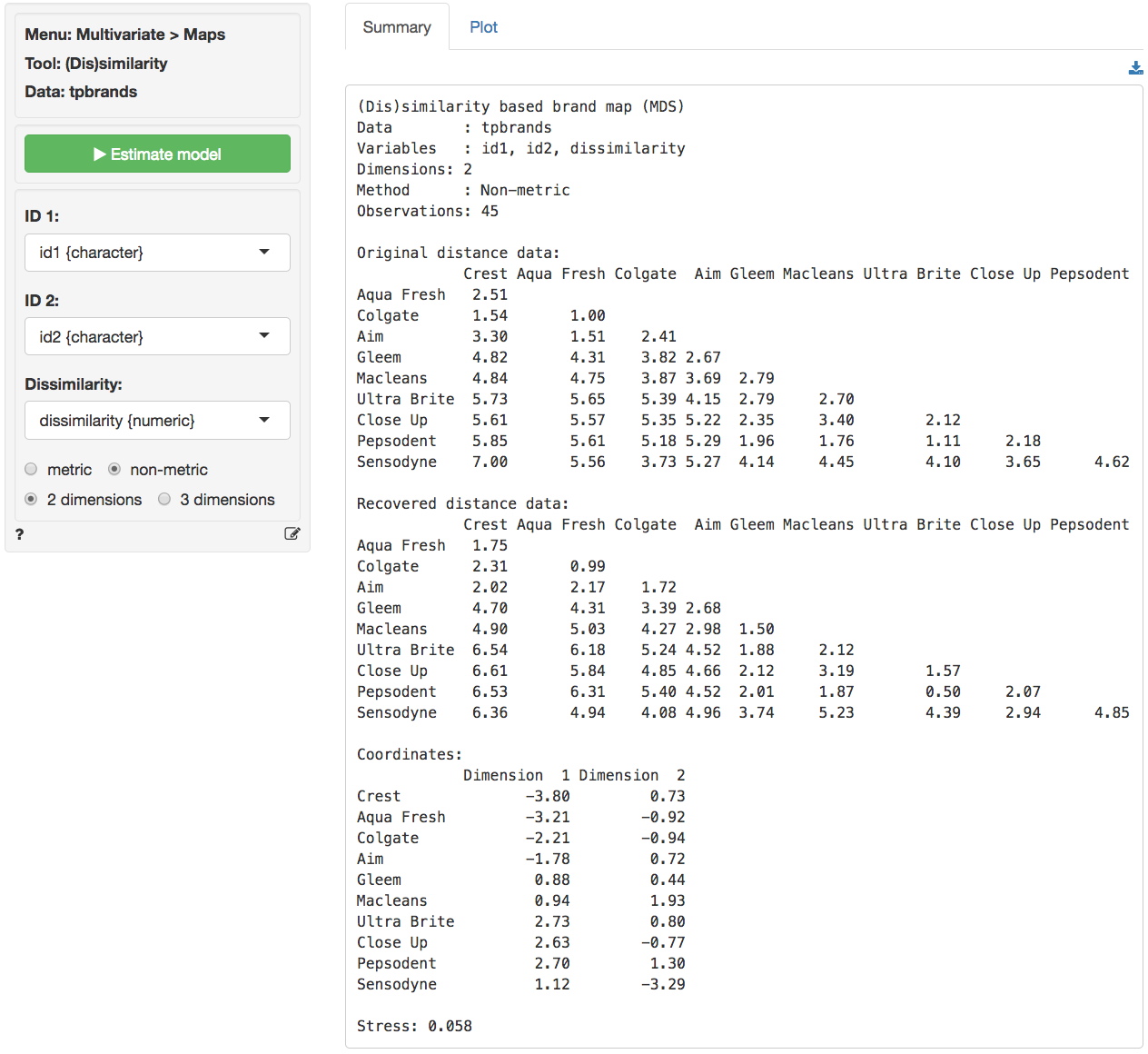

Example 2

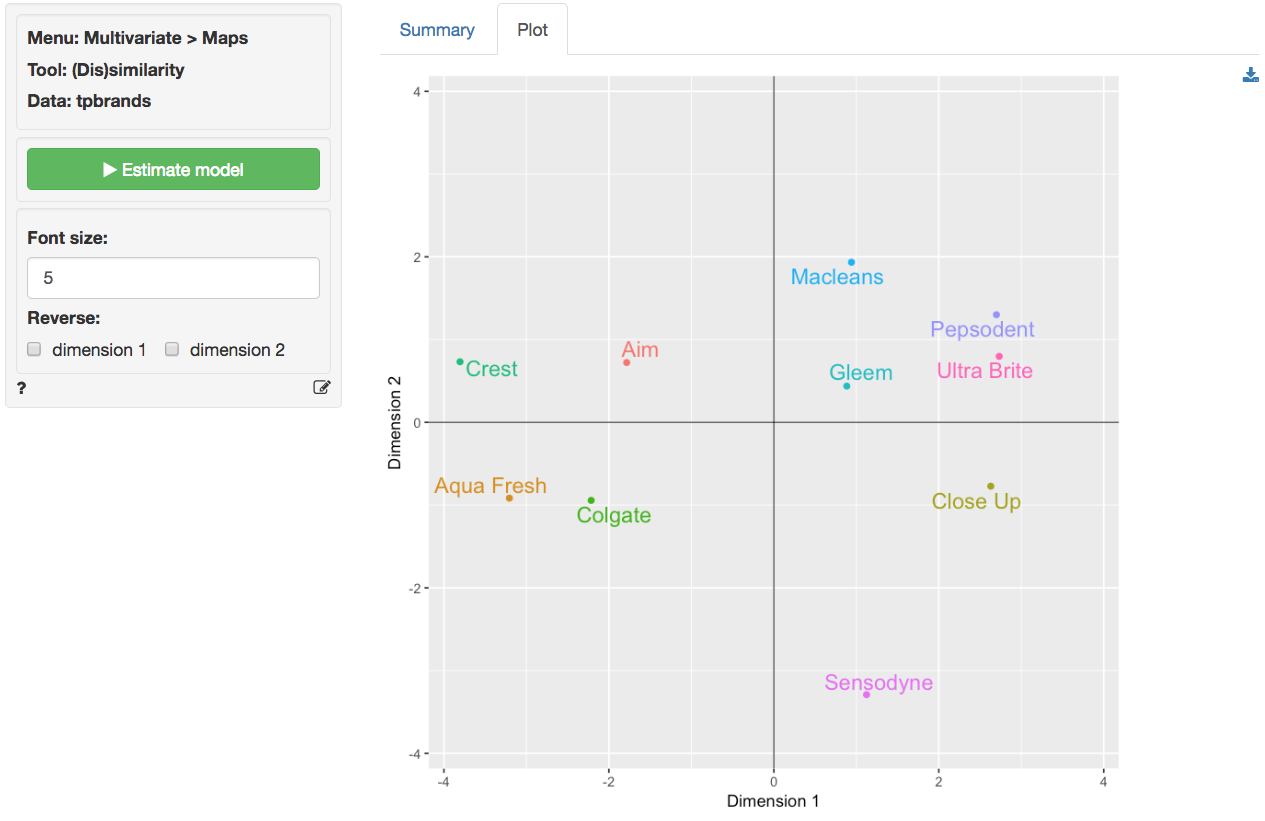

The following plot is based on similarity data for a set of

toothpaste brands (tpbrands is available as one of the

example datasets). Respondents were asked the following question:

“Please rate the following pairs of toothpaste brands on the basis of

their similarity (1 = very similar, 7 = very dissimilar).” for all

pairwise combinations of 10 brands, i.e., 45 comparisons. MDS will try

to create a map that reproduces, as accurately as possible, the original

dissimilarities (or perceptual distances) provided by the 50

respondents. The original dissimilarity ratings are shown in (lower

triangular) matrix form in the figure below. From these data we can

already see that the respondents perceive some brands to be very similar

(e.g., Ultra Brite and Pepsodent have an average dissimilarity score of

1.11) and others to be very dissimilar (e.g., Crest and Sensodyne). The

stress value for a two-dimensional solution is reasonable (.058). As we

might expect, however, the original and recovered distances show that

the fit is not as good as for the city data.

The coordinates shown in the Summary tab are used to plot the brands in two dimensions in the Plot tab. In the plot we see that Aqua Fresh and Colgate as well as Ultra Brite and Pepsodent are located very close together. This is consistent with the original data. Sensodyne and Crest, however, are positioned at opposite ends of the plot. Again, this is consistent with the original data and provides visual confirmation that MDS was able to create a plot that fits the data reasonably well.

From the plot a manager might conclude that the brands that are closest together in the map are perceived by consumers as close substitutes and, hence, close competitors in the minds of consumers in this market segment. A manager for Aqua Fresh or Macleans, in contrast, might focus less on Sensodyne when developing a competitive positioning plan for her brand. An important limitation of brand maps based on (dis)similarity data is that the axes are difficult to interpret. For example, why are Close-up and Crest located at opposite ends along the horizontal axes? The researcher could ask respondents to explain the meaning of the axes or else obtain additional attribute information for the brands and correlate/overlay these on the plot to facilitate interpretation. Such attribute data could, however, also be used to create a brand map without the need for (dis)similarity ratings (see Multivariate > Maps > Attributes).

Report > Rmd

Add code to

Report

> Rmd to (re)create the analysis by clicking the

icon on the bottom

left of your screen or by pressing ALT-enter on your

keyboard.

R-functions

For an overview of related R-functions used by Radiant to generate brand maps see Multivariate > Maps.

The key functions used in the mds tool are

cmdscale from the stats package and

isoMDS from the MASS package.